If you’ve been hearing the buzz about artificial intelligence (AI) and wonder how you can get in on the action, look no further. This article will provide you with a concise guide on how to invest in AI stocks. With the rapid advancements in technology and the increasing reliance on AI in various industries, investing in AI stocks has become an enticing opportunity. Whether you’re a seasoned investor or just starting out, this article will walk you through the steps to take advantage of this rapidly growing sector. So, let’s dive in and learn how to make your money work for you in the exciting world of AI stocks.

Understanding Artificial Intelligence (AI) Stocks

What are AI stocks?

AI stocks are stocks of companies that are involved in the development, research, and application of artificial intelligence technologies. These companies use AI to improve efficiency, enhance productivity, and solve complex problems. AI stocks can be found in various sectors, including technology, healthcare, finance, and manufacturing.

Why invest in AI stocks?

Investing in AI stocks can be an exciting opportunity for investors. The rapid advancements in AI technology have the potential to revolutionize various industries and generate significant returns for investors. AI companies are at the forefront of innovation and have the potential for exponential growth. By investing in AI stocks, you can gain exposure to this cutting-edge technology and potentially benefit from its future success.

Types of AI stocks

There are different types of AI stocks that investors can consider. One type is the large-cap AI companies, which are established companies with a market capitalization of over $10 billion. These companies have a solid financial foundation and a proven track record.

Another type is the mid-cap AI companies, which have a market capitalization between $2 billion and $10 billion. These companies are in the growth phase and may have the potential for higher returns.

Lastly, there are small-cap AI companies, which have a market capitalization of under $2 billion. These companies are often in the early stages of development and may carry higher risks but also offer the possibility of substantial growth.

Researching AI Stocks

Identify reputable AI companies

When researching AI stocks, it is important to identify reputable AI companies. Look for companies that have a strong track record in AI technology development and have demonstrated expertise in their respective fields. Consider companies that are recognized as leaders in AI innovation and have a portfolio of successful projects or products.

Analyze financial performance

Analyzing the financial performance of AI companies is crucial before making an investment decision. Look at key financial indicators such as revenue growth, profitability, and debt levels. Evaluate the company’s financial stability and the ability to generate consistent earnings. Additionally, examine the company’s cash flow and its ability to fund future research and development.

Evaluate competitive advantages

Assessing the competitive advantages of AI companies is essential when researching AI stocks. Look for companies that have proprietary AI technology, unique algorithms, or exclusive data sets that give them a competitive edge. Consider whether the company has established barriers to entry that protect its market position and ensure long-term sustainability.

Consider potential growth

Consider the potential growth opportunities for AI companies. Look for companies that are operating in industries with significant growth potential, such as autonomous vehicles, healthcare diagnostics, or natural language processing. Evaluate the company’s plans for expansion, partnerships, and new product development. Assess the addressable market size and the company’s potential to capture a significant share of it.

Diversification in AI Investing

Spreading investments across sectors

Diversification is an important risk management strategy when investing in AI stocks. Instead of focusing solely on one sector, consider spreading your investments across various sectors that utilize AI technology. This helps mitigate the risk associated with any single sector’s performance. By diversifying, you can potentially benefit from the growth of multiple sectors and reduce the impact of unfavorable market conditions.

Investing in both established and emerging companies

To achieve a balanced portfolio, consider investing in both established and emerging AI companies. Established companies provide stability and a proven track record, while emerging companies offer potential for significant growth. Balancing investments between the two can help manage risk and capture growth opportunities in different stages of the AI industry.

Allocating investments across different market caps

Allocating investments across different market capitalizations can also contribute to diversification. Consider investing in a mix of large-cap, mid-cap, and small-cap AI stocks. Large-cap companies tend to be more stable, while small-cap companies have the potential for higher growth. By diversifying across different market caps, you can balance risk and potential returns.

AI Stocks on Major Stock Exchanges

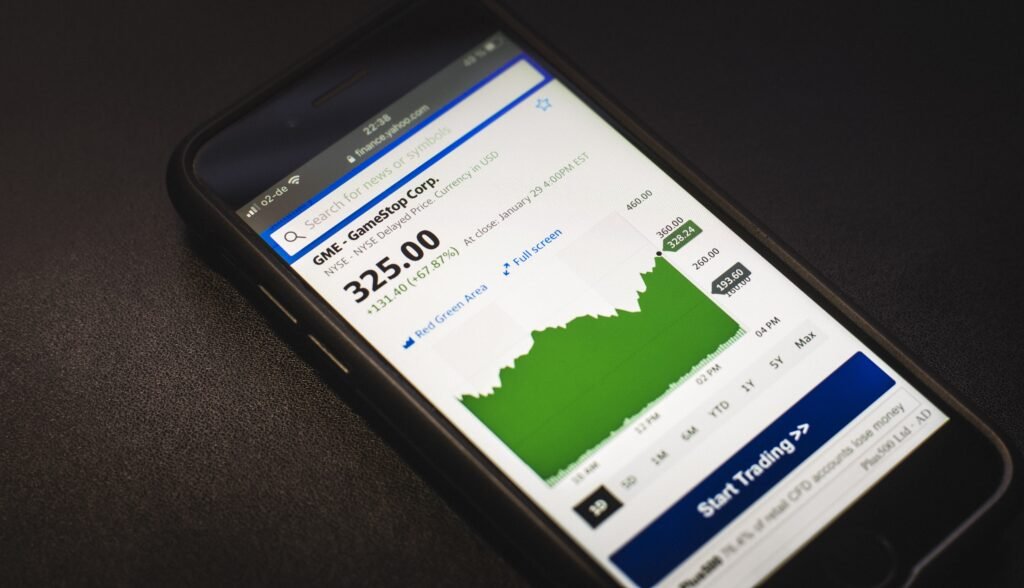

Investing in AI stocks on NYSE

The New York Stock Exchange (NYSE) offers a wide range of AI stocks for investors to consider. Many established AI companies are listed on the NYSE, providing opportunities for long-term investment. Research companies listed on the NYSE and consider the potential growth prospects, financial performance, and competitive advantages of individual AI stocks before making investment decisions.

Investing in AI stocks on NASDAQ

NASDAQ is another major stock exchange that offers a variety of AI stocks. NASDAQ is known for its technology-oriented listings, making it a favorable exchange for investors interested in the AI industry. Researching and analyzing AI stocks listed on NASDAQ can provide opportunities to invest in both well-established AI companies and emerging AI startups.

Investing in AI stocks on London Stock Exchange

The London Stock Exchange is a global marketplace that offers AI stocks to investors. It provides access to AI companies from various sectors, including technology, healthcare, and finance. Investors interested in AI stocks on the London Stock Exchange should research the specific companies listed, evaluate their financial performance, and consider any potential risks and rewards before making investment decisions.

Investing in AI stocks on Shanghai Stock Exchange

For investors looking for opportunities in the Asian market, the Shanghai Stock Exchange offers AI stocks from China. China has a rapidly growing AI industry and is home to several leading AI companies. However, investing in the Shanghai Stock Exchange requires thorough research and understanding of the Chinese market and regulatory environment.

Investing in AI Exchange-Traded Funds (ETFs)

Understanding AI ETFs

AI exchange-traded funds (ETFs) are investment funds that are traded on stock exchanges. These funds provide investors with exposure to a diversified portfolio of AI stocks. AI ETFs are designed to track the performance of a specific AI index or a basket of AI stocks. By investing in AI ETFs, investors can gain exposure to the overall performance of the AI industry rather than investing in individual AI stocks.

Benefits of investing in AI ETFs

Investing in AI ETFs offers several benefits to investors. First, it provides instant diversification across multiple AI stocks, reducing the risk associated with investing in individual companies. Second, AI ETFs offer liquidity as they can be bought and sold on stock exchanges throughout the trading day. Lastly, investing in AI ETFs can be a cost-effective way for investors to gain exposure to the AI industry, as the fees associated with ETFs are generally lower compared to actively managed funds.

Top AI ETFs to consider

There are several AI ETFs available to investors. Some of the top AI ETFs to consider include the Global X Robotics & Artificial Intelligence ETF (BOTZ), the AI Powered Equity ETF (AIEQ), and the ARK Autonomous Technology & Robotics ETF (ARKQ). These ETFs provide exposure to a diversified portfolio of AI-related companies, including robotics, automation, and machine learning.

Researching and Analyzing AI Companies

Factors to consider when researching AI companies

When researching AI companies, there are several key factors to consider. First, evaluate the company’s expertise in AI technology and its ability to innovate. Look for companies that have a strong research and development program and a talented team of AI experts. Additionally, consider the company’s business model, growth strategy, and competitive positioning within the AI industry.

Analyzing company financial statements

Analyzing company financial statements is essential to understand the financial health and performance of AI companies. Review the company’s income statement, balance sheet, and cash flow statement to assess revenue growth, profitability, and liquidity. Pay attention to key financial ratios and metrics such as earnings per share, return on equity, and debt-to-equity ratio.

Understanding AI-related patents and intellectual property

Patents and intellectual property play a crucial role in the AI industry. Assess the number of patents granted to AI companies and the quality of their intellectual property portfolio. Companies with a strong patent portfolio have a competitive advantage and are better positioned to protect their innovations and monetize their technology.

Examining partnerships and collaborations in the AI industry

Partnerships and collaborations can provide valuable insights into an AI company’s growth potential. Analyze the company’s partnerships with other AI companies, research institutions, or industry leaders. These collaborations can contribute to knowledge sharing, research advancements, and market access, which can ultimately impact the company’s success and market position.

Investing in AI Startups

Understanding the startup landscape

Investing in AI startups can be an opportunity to gain exposure to groundbreaking technologies and potentially high returns. However, it is important to understand the startup landscape and the associated risks. AI startups are often in the early stages of development and may have limited financial resources, making them more vulnerable to failure. Thorough research and careful due diligence are crucial when considering investment in AI startups.

Identifying promising AI startups

Identifying promising AI startups requires in-depth research and analysis. Look for startups that have a unique technology or solution with a strong market potential. Consider startups that have a talented and experienced leadership team, a clear business strategy, and a scalable business model. Assessing market demand, competitive landscape, and the startup’s ability to execute its plans are also important factors to consider.

Researching funding rounds and investors

Researching the funding rounds and investors of AI startups can provide valuable insights into the startup’s potential. Look for startups that have secured funding from reputable venture capital firms or angel investors with a track record in the AI industry. Consider the amount of funding raised, the milestones achieved, and the startup’s ability to attract subsequent funding rounds.

Assessing the leadership team and advisors

The leadership team and advisors of an AI startup play a crucial role in its success. Assess the experience, expertise, and track record of the startup’s founders and executives. Look for leadership teams with a diverse skill set and a deep understanding of the AI industry. Additionally, consider the quality and relevance of the startup’s advisors, as they can provide valuable guidance and industry connections.

Potential risks and rewards of investing in startups

Investing in AI startups carries both risks and rewards. Startups are inherently risky investments, and not all startups succeed. AI startups may face challenges such as technology development hurdles, market adoption, and competitive pressures. However, successful investments in startups can lead to significant returns, as startups have the potential for rapid growth and can disrupt traditional industries.

Monitoring AI Industry Trends

Staying updated on technological advancements

To stay informed about AI industry trends, it is important to stay updated on technological advancements. Follow industry publications, research papers, and news outlets that cover AI developments. Attend conferences, webinars, and workshops focused on AI to gain knowledge about the latest technologies, applications, and breakthroughs in the field.

Identifying emerging AI applications and sectors

Identify emerging AI applications and sectors to stay ahead of the curve. AI technology is constantly evolving, and new applications are being discovered in various industries. Keep an eye on sectors such as autonomous vehicles, healthcare diagnostics, cybersecurity, and natural language processing, as these are areas where AI is expected to have a significant impact.

Understanding regulatory landscape and policies

Stay informed about the regulatory landscape and policies surrounding AI. AI technologies are subject to regulations related to data privacy, ethical considerations, and safety. Understanding the regulatory environment is crucial for investors, as it can impact the adoption and commercialization of AI technologies. Stay updated on changes in regulations and government policies that may affect AI companies.

Monitoring market sentiment and investor interest

Monitor market sentiment and investor interest in the AI industry. Pay attention to trends in AI stock prices, trading volumes, and analyst reports. Follow discussions and opinions of industry experts and analysts to gain insight into market sentiment. Monitoring investor interest can help identify emerging opportunities and potential risks in the AI market.

Managing Risks in AI Investing

Diversification as a risk management strategy

Diversification is a key risk management strategy when investing in AI stocks. By diversifying investments across different AI companies, sectors, and market caps, you can spread the risk and reduce the impact of any single investment. Diversification helps protect against company-specific risks and allows investors to capture potential growth opportunities from different segments of the AI industry.

Understanding market volatility

Market volatility is an inherent risk when investing in any stocks, including AI stocks. Understand that the value of AI stocks can fluctuate significantly due to market conditions, economic factors, and investor sentiment. It is important to have a long-term investment perspective and be prepared for short-term volatility in AI stock prices.

Evaluating company-specific risks

Evaluate company-specific risks when investing in AI stocks. Assess factors such as competition, regulatory risks, technology adoption, and potential disruption to the company’s business model. Thoroughly research and understand the risks associated with each AI company before making investment decisions.

Monitoring geopolitical risks

Geopolitical risks can impact the AI industry and individual AI companies. Factors such as trade tensions, government policies, and international relations can affect the growth prospects and operations of AI companies. Stay informed about geopolitical developments that may impact the AI industry and evaluate their potential impact on investments.

Considering long-term investment horizon

Considering a long-term investment horizon is important when investing in AI stocks. The development and adoption of AI technologies may take time, and the full impact of AI on various industries may not be realized immediately. By having a long-term investment horizon, investors can capture the potential growth and value creation that AI technologies can offer.

Seeking Professional Advice

Consulting with financial advisors

Consulting with financial advisors can provide valuable guidance when investing in AI stocks. Financial advisors can assess your investment goals, risk tolerance, and time horizon to develop a personalized investment strategy. They can provide insights into AI trends, individual AI companies, and potential risks and rewards. Consider working with a qualified financial advisor to make informed investment decisions.

Engaging with AI industry experts

Engaging with AI industry experts can offer valuable insights into the AI industry and individual AI companies. Attend conferences, webinars, or workshops where AI experts share their knowledge and expertise. Engaging with experts can help deepen your understanding of the AI industry and provide valuable perspectives when making investment decisions.

Joining investment communities and forums

Joining investment communities and forums focused on AI investing can provide access to a community of like-minded investors. These communities allow for discussions, sharing of insights, and the exchange of investment strategies. Engaging with fellow investors can broaden your knowledge, help validate investment ideas, and provide a supportive network for learning and collaboration.

In conclusion, investing in AI stocks can be an exciting and potentially rewarding opportunity. By understanding AI stocks, researching and analyzing AI companies, diversifying investments, monitoring industry trends, and managing risks, you can make informed investment decisions in the dynamic and rapidly evolving field of artificial intelligence. Seek professional advice, stay informed, and keep a long-term perspective to navigate the evolving landscape of AI investing successfully.